|

Sometimes, unaccepted Items are returned by customer. Normally customer comes with the items to return and entering those item in Sale Return constitutes the Credit Note.

|

|

The Credit Note in respect of Items returned affects both Inventory and Accounts. The stock of Items returned get increased. The customer account (who returns the goods) is credited by net amount of the Credit Note. Sale (or Sale Return) Account is debited (decreased) by value of Items returned. Respective ledgers of other accounts (like Taxes) are also debited accordingly.

|

|

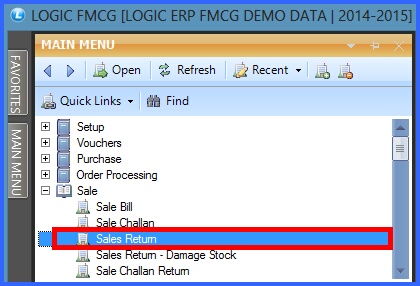

Sale Return (Credit Node) : Main Menu> Sale> Sale Return.

|

Main Menu Main Menu

FIG 1. MAIN MENU

|

Contents:

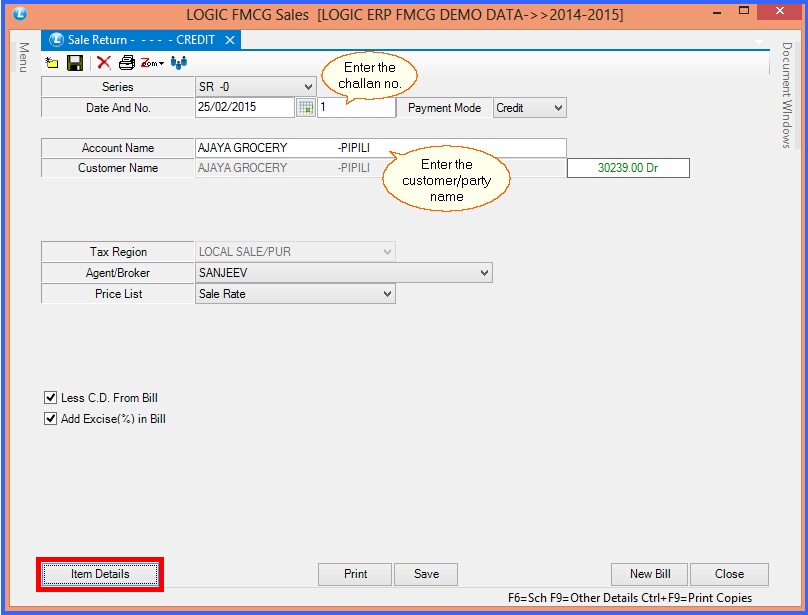

Header Details:

|

Series- Specify the Return Series which is the combination of the Series and the Number (the Series and the Number that have been specified for that Series in the setup Bill Seriesform).

|

|

Date And No- Specify the Date and the Number for the sale return.

|

|

Payment Mode- Select the mode of payment as Cash, Credit or Cheque.

|

|

Cash- If the payment mode is set to Cash and the user does not specify the customer name then the Cash Customer button is activated. The Setup Cash Bill Customers form will open up in which the user can specify customer name, city, address 1/2/3, second address 1/2/3, Cst No, Cst Date,Lst No, Lst Date, Dl. No.1 and Dl.No.2. The user can also specify the maximum number of rows in the grid. Clicking on OK button will save the record and the customer name specified will be displayed in the text box. The user can skip entering other details but customer name will have to be specified.

|

|

Cheque- If the Payment Mode is set to Cheque then the Cheque details button will be activated. Clicking on the Cheque Details button will open up the Cheque Details form. Specify the Cheque No, Cheque Date, Bank Name, Branch, Account No, Customer Name and Address. Clicking on OK button will save the details. The user can skip entering other details but Cheque No. will have to be specified.

|

|

Account / Customer Name- Press the space bar and select the account or party name to whom goods are to be returned. The Accounts that have been created using the Account\Ledger Creation form.

|

|

Tax Region- Select the tax region for the party from the list. Tax selected here will be applied on the entire return.

|

|

Agent Name- Enter the agent name if you want to assign any salesman to the party. The Agent/Salesman that have been created using the Setup Salesman form.

|

FIG 2. SALE RETURN (HEADER DETAILS)

Back To Top

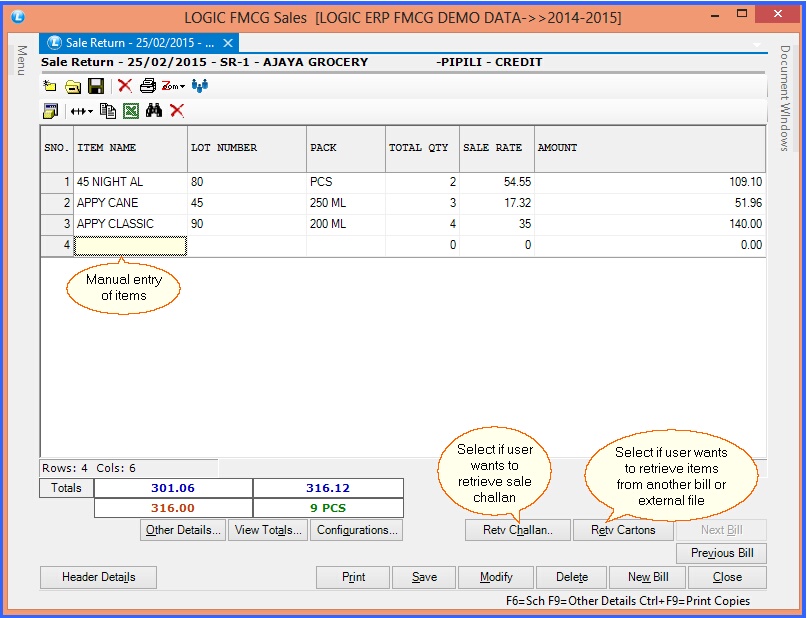

Item Details:

The Item Details in Sale Bill window will appear and then enter the following details :

|

Enter all the required item details like lot no.of the item, pack size, total quantity.

|

|

User can enter the C.D.(Cash Discount), T.D(Trade Discount), Taxes etc if any.

|

|

Click on View Totals, If user wants to see all the details of tax, discount etc on total amount.

|

FIG 3. SALE RETURN (ITEM DETAILS)

|

To save the data entered by the user, user have to press enter button and the cursor should be on next line in the grid.

|

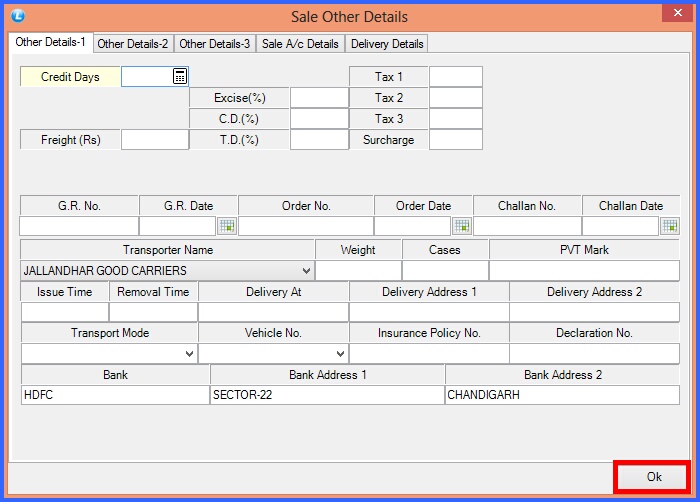

Other Details Other Details

By clicking on Other Details button or Pressing F9 a new pop up will appear in which user can specify particular Transport Name, CD, TD, Sp Cd, Taxes, Labour/Unit, Bank Details, G.R Details of the transport. By clicking on Other Details button or Pressing F9 a new pop up will appear in which user can specify particular Transport Name, CD, TD, Sp Cd, Taxes, Labour/Unit, Bank Details, G.R Details of the transport.

FIG 4. OTHER DETAILS-1

|

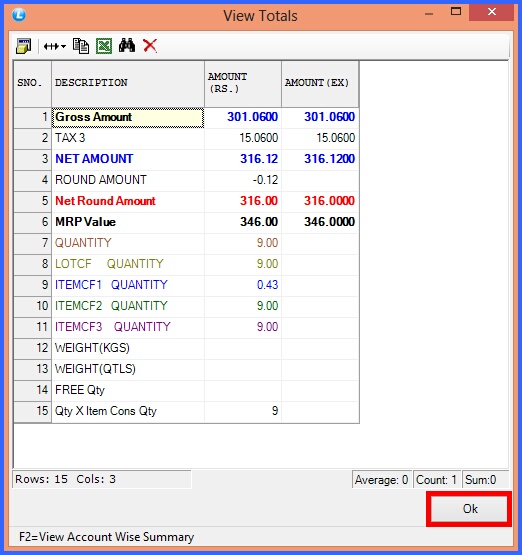

View Totals View Totals

To view all the totals of account wise summary, click on View Total Button, a pop up will appear in which user can view all the discounts, tax and other charges in View Total. To view all the totals of account wise summary, click on View Total Button, a pop up will appear in which user can view all the discounts, tax and other charges in View Total.

FIG 5. VIEW TOTALS

|

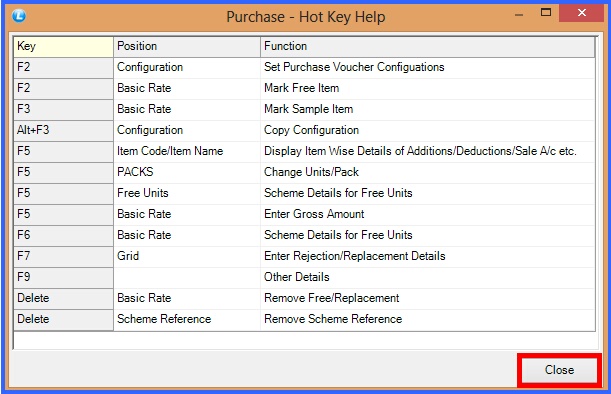

Hot Keys Hot Keys

Press F1 to view the function of all hot keys in the sale challan, below given screen will appear. Press F1 to view the function of all hot keys in the sale challan, below given screen will appear.

FIG 6. HOT KEYS

|

Back to Top

|