Sometimes, unaccepted Items are returned to supplier. This is entered in the Purchase Return (Debit Note) document.

|

On Return of Items, the customer creates a Debit Note for the Items returned.

|

|

The Debit Note in respect of Items returned affects both Inventory and Accounts.

|

|

The stock of Items returned get reduced. The suppliers account is debited by net amount of the Debit Note.

|

|

Purchase (or Purchase Return) Account is credited by value of Items returned. Respective ledgers of other accounts (like Taxes) are also credited accordingly.

|

|

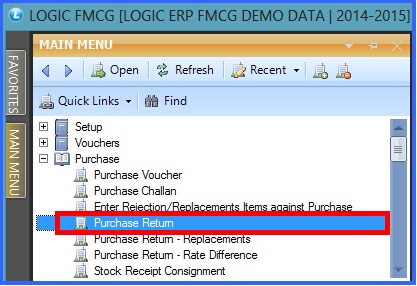

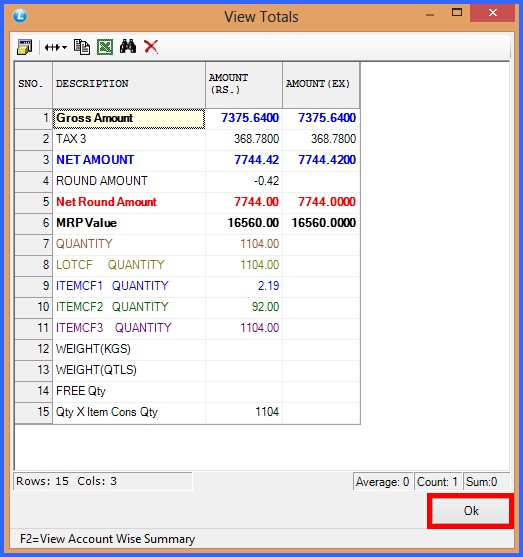

Purchase Return (Debit Note) : Main Menu> Purchase> Purchase Return.

|

Main Menu Main Menu

FIG 1. MAIN MENU

|

Contents:

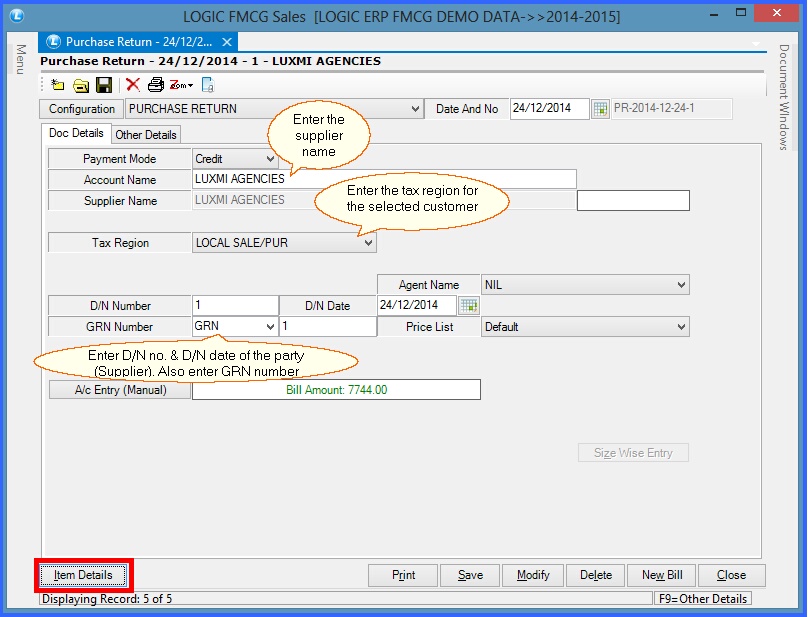

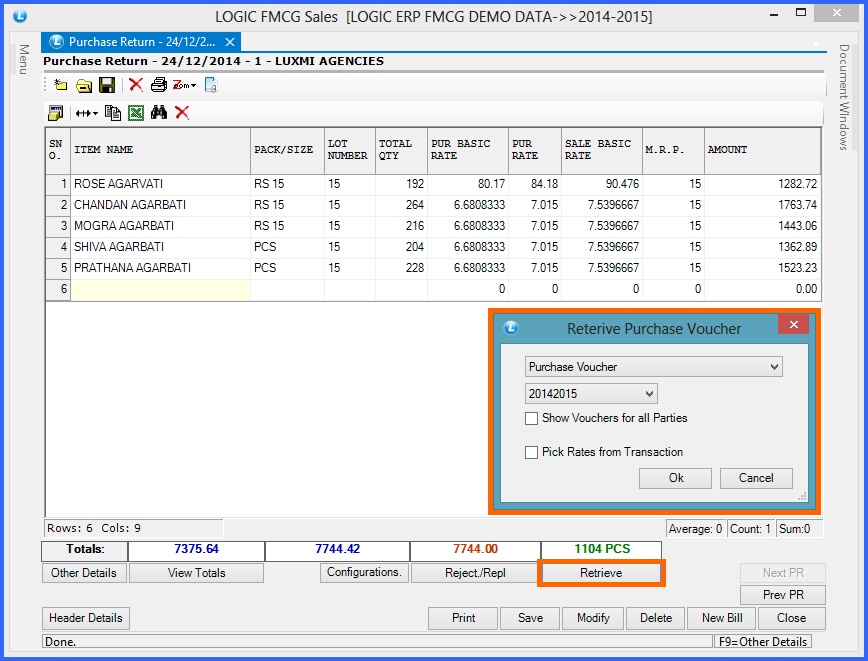

Header Details:

|

Payment Mode- Select the mode of payment as Cash, Credit or Cheque.

|

|

Cash- If the payment mode is set to Cash and the user does not specify the customer name then the Cash Customer button is activated. The Setup Cash Bill Customers form will open up in which the user can specify customer name, city, address 1/2/3, second address 1/2/3, Cst No, Cst Date,Lst No, Lst Date, Dl. No.1 and Dl.No.2. The user can also specify the maximum number of rows in the grid. Clicking on OK button will save the record and the customer name specified will be displayed in the text box. The user can skip entering other details but customer name will have to be specified.

|

|

Cheque- If the Payment Mode is set to Cheque then the Cheque details button will be activated. Clicking on the Cheque Details button will open up the Cheque Details form. Specify the Cheque No, Cheque Date, Bank Name, Branch, Account No, Customer Name and Address. Clicking on OK button will save the details. The user can skip entering other details but Cheque No. will have to be specified.

|

|

Account / Supplier Name- Press the space bar and select the account or party name from whom goods have been received. The Accounts that have been created using the Account\Ledger Creation form.

|

|

Tax Region- Select the tax region for the party from the list. Tax selected here will be applied on the entire return.

|

|

Agent Name- Enter the agent name if you want to assign any salesman to the party. The Agent/Salesman that have been created using the Setup Salesman form.

|

|

D/N Number- Enter the D/N number.

|

|

GRN (Goods Received Number)- Enter the pre-fix as PR. Enter the GRN Number first time further it is auto generated.

|

FIG 2. PURCHASE RETURN (HEADER DETAILS)

Back To Top

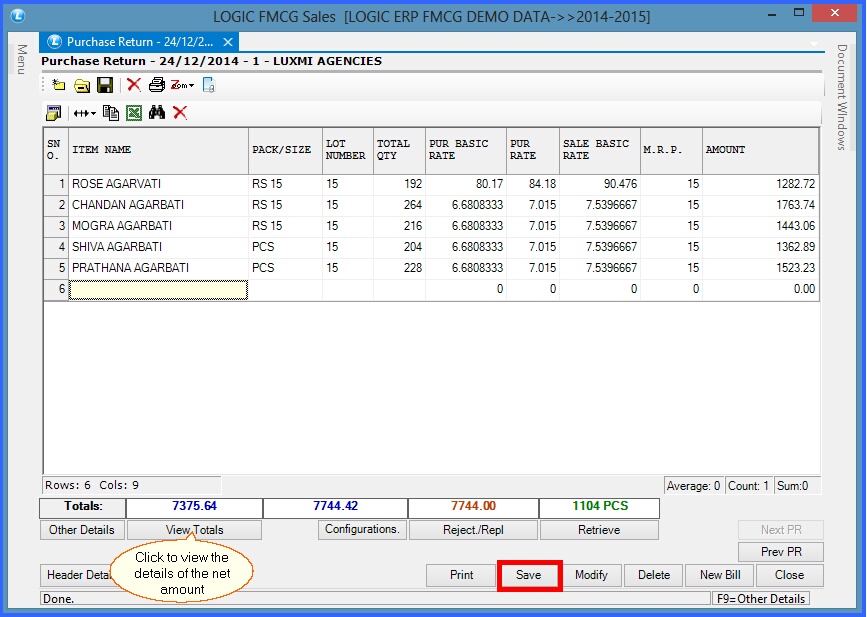

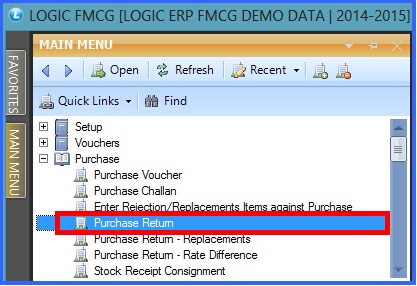

Item Details :

The Item Details in Purchase Bill window will appear and then enter the following details :

|

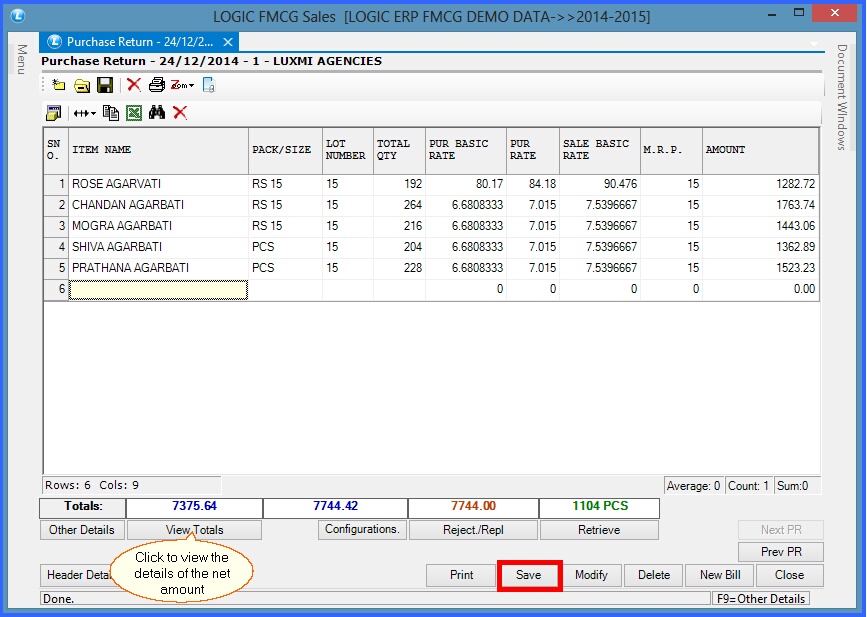

Enter all the required item details.

|

|

Lot Number- Select the lot from which user want to replace the items.

|

|

User can enter the C.D.(Cash Discount), T.D(Trade Discount), Taxes etc if any.

|

|

Click on View Totals, If user wants to see all the account wise summary of tax, discount etc on total amount.

|

|

After that click on Save button or press Alt+S.

|

FIG 3. PURCHASE RETURN (ITEM DETAILS)

|

To save the data entered by the user, user have to press enter button and the cursor should be on next line in the grid.

|

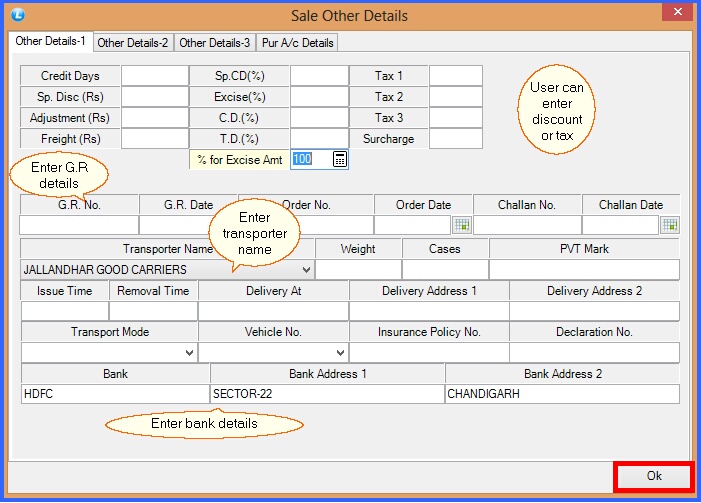

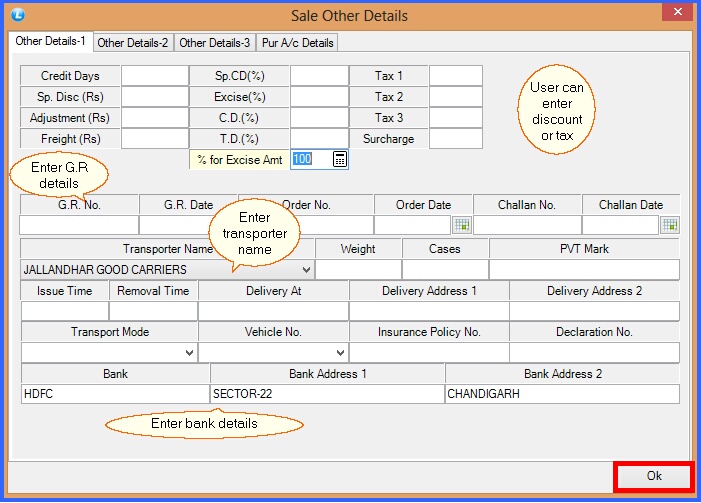

Other Details Other Details

By clicking on Other Details button or Pressing F9 user can specify particular Transport Name, CD, TD, Sp Cd, Taxes, Labour/Unit, Bank Details, G.R Details of the transport. These details are for the Bill as whole and not for the items in the bill.To specify the different details click on the relevant tabs and specify the details. By clicking on Other Details button or Pressing F9 user can specify particular Transport Name, CD, TD, Sp Cd, Taxes, Labour/Unit, Bank Details, G.R Details of the transport. These details are for the Bill as whole and not for the items in the bill.To specify the different details click on the relevant tabs and specify the details.

The discounts like CD, TD etc and taxes will be bill wise that is for whole bill. The discounts like CD, TD etc and taxes will be bill wise that is for whole bill.

FIG 4. OTHER DETAILS-1

|

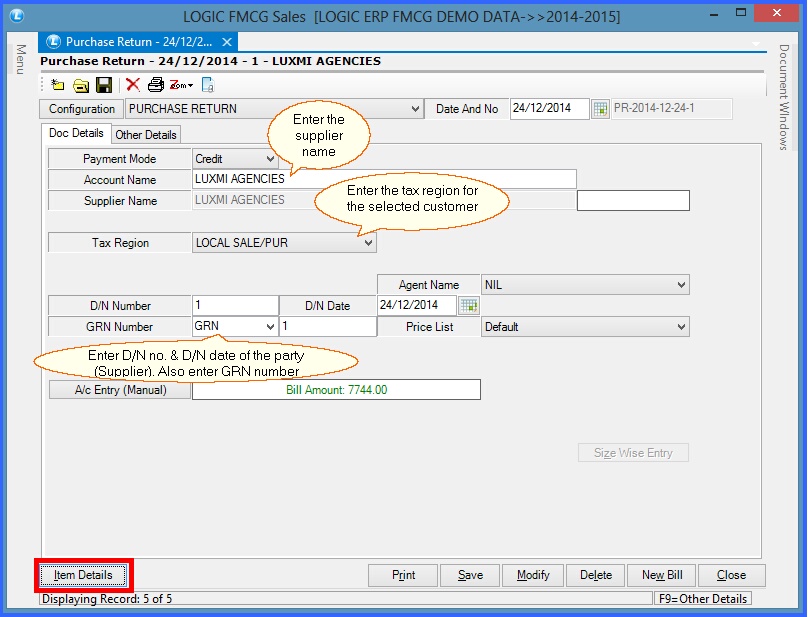

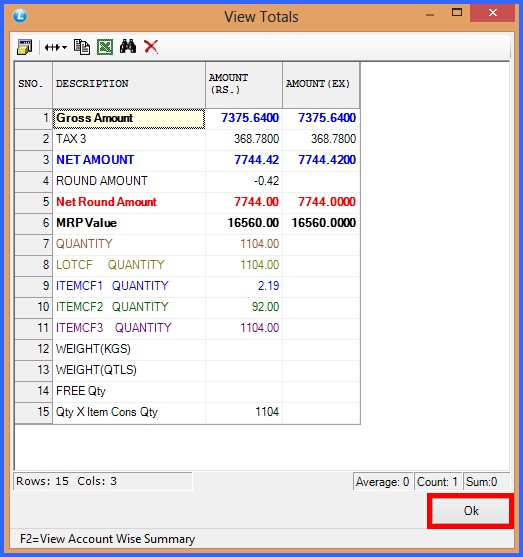

View Totals View Totals

To view all the account wise total summary, click on View Total Button. To view all the account wise total summary, click on View Total Button.

User can view the discount, tax and other charges in View Total. User can view the discount, tax and other charges in View Total.

FIG 5. VIEW TOTALS

|

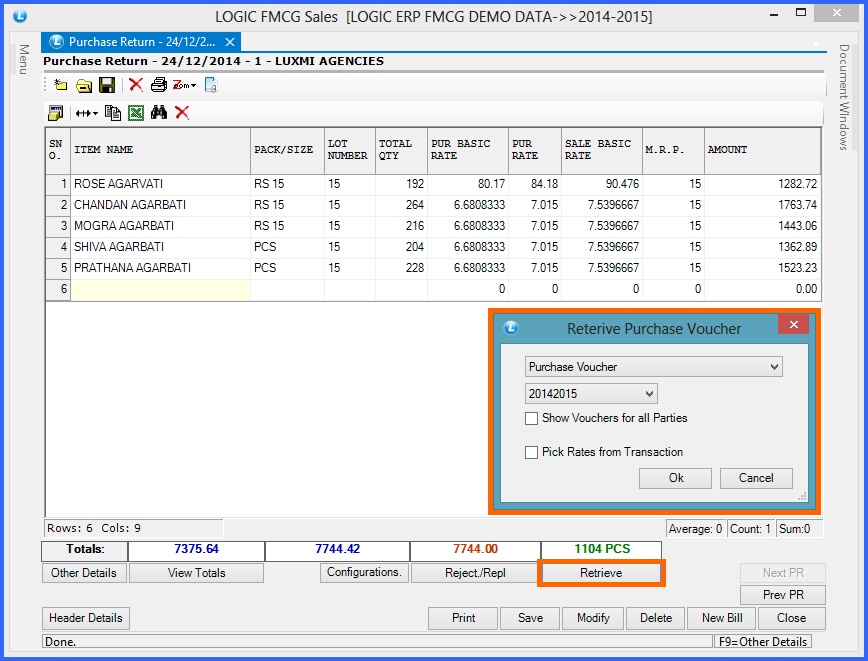

Retrieving Purchase Voucher in Purchase Return :

|

The purchase invoice can be as a whole, in part or in multiple be retrieved in the purchase return. If user want to retrieve purchase voucher then click on Retrieve Order button, a pop up will come, select the required option from the list and then Purchase Voucher search window appears showing all the invoice made by the user in Purchase Invoice form, where user can select the particular invoice which is to be retrieved.

|

|

If user want to retrieve sale return then click on Retrieve Order button, select the Sale Return option from the list and then Sale Return search window will appear showing all the return made by the user in Sale Return form. Select the required return which is to be retrieved in the bill.

|

FIG 6. PURCHASE RETURN (ITEM DETAILS)

Back To Top

|