Setup Tax Types (Purchase) Form : To define the tax types for purchase follow the under mentioned steps :-

1.

|

Click the Setup menu and select the Setup Items option from the list.

|

2.

|

Select any option from the Setup Items submenu.

|

3.

|

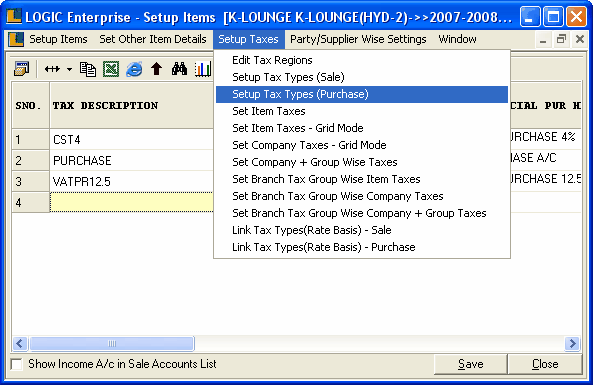

A new window appears click the Setup Taxes menu and select the Setup Tax Types (Purchase) from the list as shown in figure.

|

4.

|

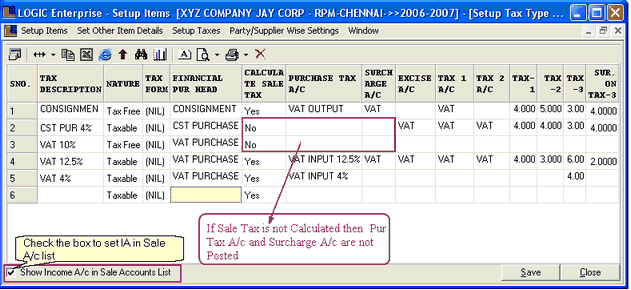

This from allows the user to define the parameters related to taxes for the purchase.User can provide Tax Description manually and it is mandatory.

|

Tax Description : is the tax type defined by user for example : VAT 5%,VAT 12.5% etc.

|

|

|

Click To Expand

|

•

|

Nature : Select the nature of the tax type from the list.There are three kinds of nature :Tax Paid,Taxable,Tax Free.This option is used in Bill Printing to create separate columns on basis of Nature.

|

•

|

Tax Form : Select the Tax Form for this tax type from the list.It is an optional column.

|

•

|

Financial Pur Head : Select the Financial purchase head for the tax type from the list.It is a mandatory column can't be left blank.

|

•

|

Calculate Sales Tax : Specify whether the sale tax is calculated or not.Select Yes or No from the list.

|

•

|

Purchase Tax Account : If Calculate Sales Tax is set to Yes,then specify the Purchase Tax Account.

|

•

|

Surcharge A/c : If Calculate Sales Tax is set to Yes,then specify the Surcharge Account.If the this field is not set, then we are not able to specify surcharge A/c.

|

•

|

Excise A/c : Excise A/c is specified only when excise is charged on purchase.This option will only work in case Tax 3 (Sales Tax) and Excise in the Bill are set to Bill Wise.

|

•

|

Tax 1 A/c : Specify Tax 1 Account in case any Tax 1 is charged on the Purchase. This option will only work in case Tax 3 (Sales Tax) and Tax 1 in the Bill are set to Bill Wise.

|

•

|

Tax 2 A/c : Specify Tax 2 Account in case any Tax 2 is charged on the Purchase . This option will only work in case Tax 3 (Sales Tax) and Tax 2 in the Bill are set to Bill Wise.

|

•

|

Taxes : Enter the values for taxes manually.There are three Tax columns : Tax-1,Tax-2,Tax-3.User can specify the percentage values in these fields.

|

•

|

Surcharge On Tax-3 : Specify the surcharge on the Tax-3.It is also specified in percentage.For example : Surcharge is 4% of Tax-3.

|

|

•

|

How To Display The Income A/c In Sale A/c List

|

In order to view the Income A/c in the Sale A/c List check the box  to add Income A/c in Sale A/c List.In the list it is named as IA (Income A/c). to add Income A/c in Sale A/c List.In the list it is named as IA (Income A/c).

|

•

|

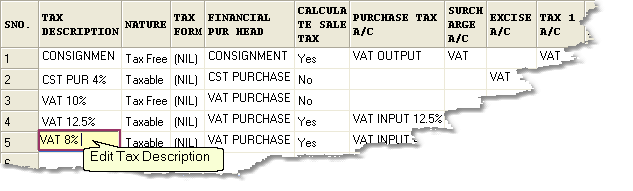

How To Modify Existing Record

|

In order to modify the existing record,select the record which you want to modify make the necessary changes and click on Save button or press Alt+S to save the changes.

|

|