Account Type: A name given to an account that indicates the account's purpose. The account type has to be specified. The account type can be set to Customer, Supplier, Cash, Bank etc. Account Type: A name given to an account that indicates the account's purpose. The account type has to be specified. The account type can be set to Customer, Supplier, Cash, Bank etc.

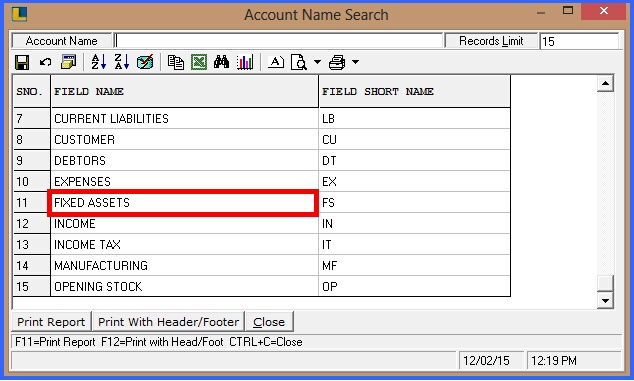

Press space bar and select the required field depending upon your account. Below given window will appear for the selection of the account type: Press space bar and select the required field depending upon your account. Below given window will appear for the selection of the account type:

FIG 2. ACCOUNT TYPE

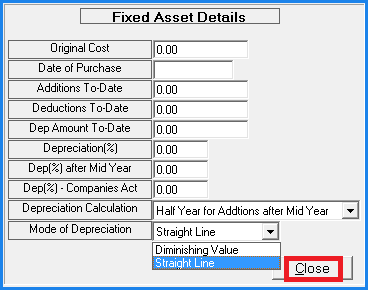

For Example- If you select the Fixed Asset:

When the account type is set to Fixed Assets then clicking on Other Details Button as shown in the Fig1, the Fixed Asset Detail form as given in the below fig will pop up. The user can enter various details like Original Cost, Purchase Date, Addition/Deduction To Date, Depreciation percentage etc.

Fig 3. Fixed Asset Detail Form

The user can enter the Mode of Depreciation which can be either Straight Line or Diminishing.

Straight Line:When the Mode Of Depreciation is set to Straight Line then whatever Depreciation Percentage has been set will be on the Original cost over the years. Straight Line:When the Mode Of Depreciation is set to Straight Line then whatever Depreciation Percentage has been set will be on the Original cost over the years.

For example If the user has bought an item for 1000 and the Depreciation Percentage is set to 10% then over the years 10% will be deducted from the Original Cost like after first year it will be 900 then 800 then 700 and so on.

Diminishing Value :When the Mode Of Depreciation is set to Diminishing Value then whatever Depreciation Percentage has been set will not be on the Original Cost over the years. Diminishing Value :When the Mode Of Depreciation is set to Diminishing Value then whatever Depreciation Percentage has been set will not be on the Original Cost over the years.

For example If the user has bought an item for 1000 and the Depreciation Percentage is set to 10% then over the years 10% will not be deducted on Original Cost but on Cumulative Cost like after first year it will 900 then next year 10% will be deducted from 900 and not from Original Cost i.e. 1000.

|