Get LOGIC ERP to enhance financial management in your retail business. Effortlessly track Profit & Loss statements, streamline expenses and boost profits with real-time data. Book demo today!

In the retail industry, numbers speak louder than words — and the Profit & Loss Statement is the voice of your business. Acting as a financial compass for retailers, it offers a concise view of income vs expenditure. It reveals what’s working, highlights areas of concern, and empowers retail leaders to align strategies with results.

From budgeting and forecasting to evaluating store performance, a retail profit and loss statement demonstrates the exact monetary details regarding revenue and expenditure analysis within a predefined time. The statement shows whether your business brings in profit or stands with losses.

What is a Profit and Loss Statement?

The financial report called the profit and loss statement demonstrates business revenue compared to expenses throughout a chosen measurement period such as monthly or yearly. The statement details all business expenses starting from sales and ending with cost of goods sold and rent payments, salaries as well as various other financial outlays. The statement reveals whether your company operated at a profit level or experienced a monetary deficit.

The statement provides retailers with the much required details about their financial standing, which supports their choices and operational decisions. Whether you’re scaling up, streamlining costs, or chasing better margins, the P&L sets a roadmap to long-term success in retail business.

Profit and Loss Account Format in Retail Business

The profit and loss account format in retail includes key sections like total sales, cost of goods sold (COGS), gross profit, operating expenses, and net profit. It helps store owners track earnings and spending.

Example:

Sales: ₹1,00,000

COGS: ₹60,000

Gross Profit: ₹40,000

Expenses (Rent, Salary): ₹20,000

Net Profit: ₹20,000

This format gives a clear view of how much the business is gaining profit after covering all costs. Retailers use it to manage finances and improve profit margins.

Components of a Profit and Loss Statement

Revenue / Sales

Revenue or sales refer to the total income generated by a business through the sale of its products or services. This is the starting point of a profit and loss statement, and it includes all forms of sales, whether cash or credit. Accurate reporting of sales is crucial for evaluating business performance and understanding growth potential. For example, if you run a retail store, your total revenue comes from the sale of products to customers.

Cost of Goods Sold (COGS)

COGS combines production-related direct expenses with the costs of goods you buy, which become available for sale within a defined period. A business computes COGS as expenses related to both raw materials and direct labor and manufacturing costs. The determination of sustainable costs to produce goods depends on COGS results along with their use in gross profit calculations. Your handmade furniture production includes both the wooden materials and crafting tools and working labor in the calculation of COGS.

Gross Profit

The calculation of gross profit requires the deduction of total revenue by cost of goods sold (COGS) cost. The gross profit figure shows basic earnings before any operating expenditures are subtracted from the total. A business can use this figure to measure production efficiency in addition to product procurement efficiency, as it serves as a fundamental profitability metric.

Operating Expenses

Operating expenses are the day-to-day costs required to run the business, excluding COGS. These include rent, salaries, utilities, marketing, and administrative costs. Effective management of operating expenses is vital for maintaining profitability.

Operating Profit

Operating profit is derived by subtracting operating expenses from gross profit. It reflects the earnings from core business operations.

Net Profit or Loss

Net profit or loss is the final result after all expenses, including taxes, have been deducted from revenue. If the expenses exceed revenue, the business faces a net loss.

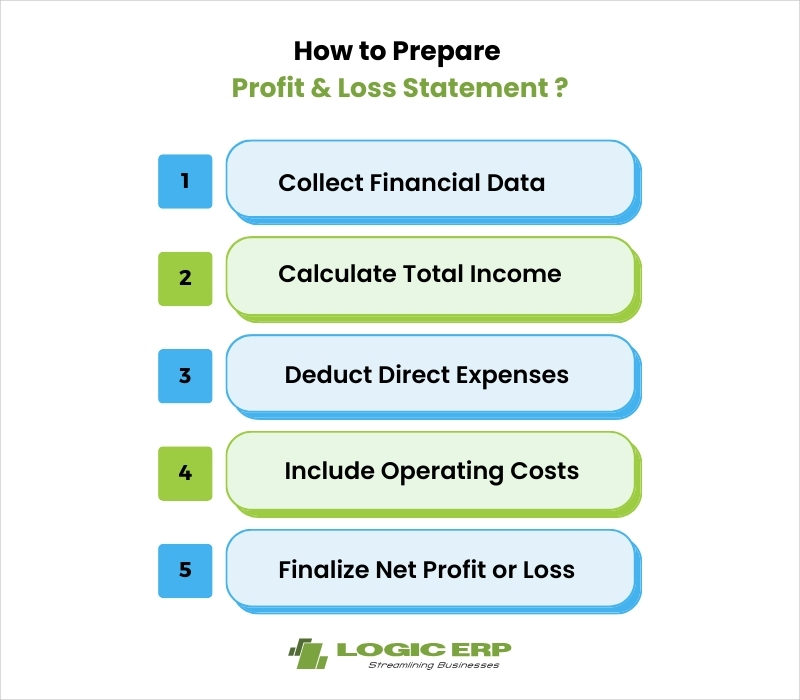

How to Prepare a Profit & Loss Statement ?

A Profit and Loss (P&L) statement helps you assess the financial health of your business by tracking income and expenses. Follow these steps to prepare a P&L statement:

Step 1: Collect Financial Data

Start by collecting all your financial documents, such as sales invoices, receipts, and expense records. Ensure that you have all the details for the specific period you’re reporting, whether monthly, quarterly, or annually.

Step 2: Calculate Total Income

Next, add up all your sources of revenue. This includes sales, service income, and any other income streams like interest or rental income. Make sure to record both cash and credit sales to get an accurate picture.

Step 3: Deduct Direct Expenses

Direct expenses, also known as the Cost of Goods Sold (COGS), include the costs associated with producing or purchasing the goods you sell. The business needs to monitor its three basic cost components: raw materials, alongside labor expenses and production costs. Subtract this from your total income to calculate your gross profit.

Step 4: Include Operating Costs

Operating costs cover day-to-day expenses such as rent, utilities, salaries, marketing, and other business expenses not directly tied to production. Deduct these from your gross profit to find your operating profit.

Step 5: Finalize Net Profit or Loss

Finally, subtract any taxes and other non-operating expenses to determine your net profit or loss. This shows whether your business is profitable or facing a loss during the given period.

By following these steps, you can create an accurate P&L statement to help make informed business decisions.

How LOGIC ERP Helps You Get Profit & Loss Statement of Your Retail Business?

LOGIC ERP software helps you simplify the process of generating accurate and real-time Profit & Loss (P&L) statements for your retail business. By automatically capturing sales, purchases, expenses, returns, taxes, and other financial transactions across all stores and channels, LOGIC ERP software compiles this data into a comprehensive P&L report.

With just a few clicks, retailers can view detailed insights into revenues, cost of goods sold, operational expenses, and net profit. The system also offers customizable filters for date ranges, store locations, and product categories, helping you analyze performance, compare trends, and make informed business decisions with confidence.

Take control of your business’s finances by easily generating detailed Profit & Loss statements with LOGIC ERP. Call us at +91-734 114 1176 to schedule a free demo or send us an email at sales@logicerp.com now!

Frequently Asked Questions (FAQ’s)

Is P&L the same as an income statement?

The P&L statement operates as an income statement for holding financial data reporting purposes. Both financial statements reveal business revenue along with costs and expenses, which allows owners to determine profitability or loss during the specified period.

Who uses profit and loss statements?

P&L statements are used by business owners, accountants, investors, lenders, and managers to evaluate a company’s financial performance, profitability, and risks.

How often should P&L statements be prepared?

P&L statements should be prepared regularly, typically on a monthly, quarterly, or annual basis, depending on the business’s needs and size.