Looking for the best payroll software for HR & employee management? Get LOGIC ERP: #1 cloud based online salary payroll software & manage your employees, salary, attendance with ease and accuracy today!

Introduction

Payroll isn’t just about paying employees; it’s about accuracy, compliance, and ensuring your workforce feels valued and supported. From managing employee records to processing varied salary modes, overtime, and statutory compliance, there are many processes involved in payroll management that can take out your sweat for maintaining accuracy everytime. At this hour of need, you will look for the best online payroll software solution which can offer advanced features to handle every aspect of payroll tasks with automation, accuracy, and compliance.

Introducing LOGIC ERP Payroll Management Software to stress out the headaches of payroll processes with a robust, scalable, and intuitive system. This advanced payroll management solution is designed to handle every detail from employee attendance to tax calculations. Now, you can easily handle the complexities of payroll processing, especially for companies with diverse needs across multiple branches.

Read this article to explore the top features of Payroll Management Software and discover why it’s an ideal choice for modern businesses.

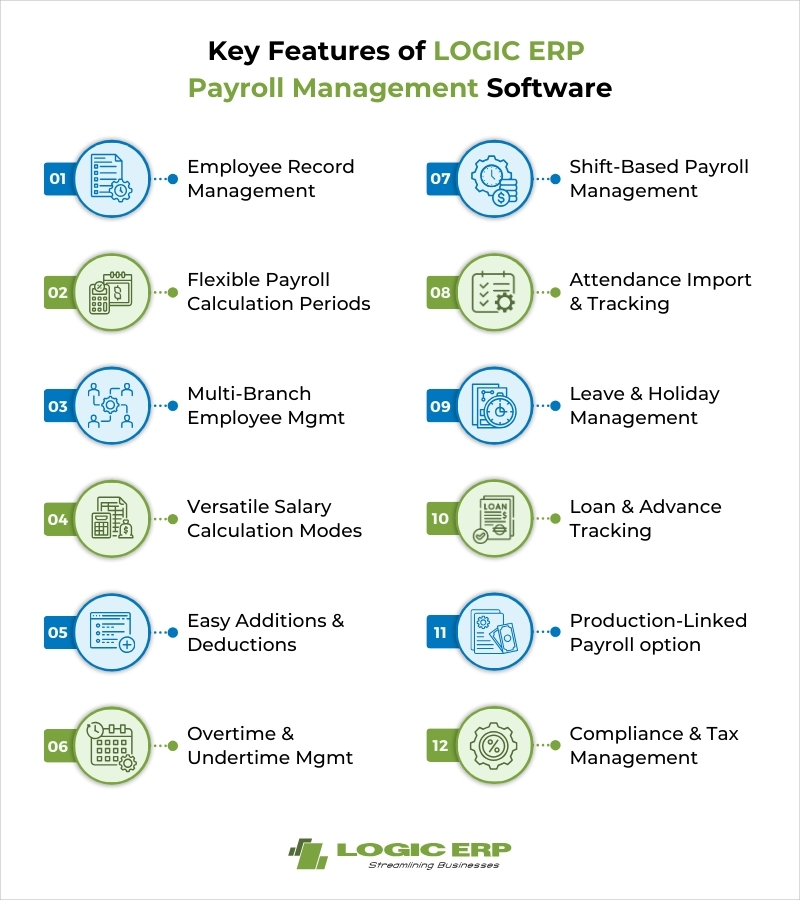

Key Features of LOGIC ERP Payroll Management Software

1. Employee Record Management

No matter how large is the employee strength in your company, our best payroll system makes it easy to maintain detailed employee records digitally, including attaching essential documents to each profile. Say goodbye to means to paper files or scrambling to find records during audits with our employee payroll management system. Everything from contact details to tax information is well organized and accessible with just a few clicks.

2. Flexible Payroll Calculation Periods

The software supports flexible payroll calculation periods, allowing businesses to define payroll cycles based on specific requirements. Whether calculated monthly or at a user-defined interval, our HR & Payroll Software adapts to unique payroll structures without requiring manual recalibration.

3. Multi-Branch Employee Management

For companies with multiple locations, managing payroll can become complicated. Here comes the solution with advanced multi-branch employee management software. Its advanced capabilities enable centralized control across all locations. HR teams can now manage payroll processes seamlessly with advanced multi-branch employee management features, ensuring every employee receives consistent and timely payment no matter where they work.

4. Versatile Salary Calculation Modes

One of the top features of payroll management software is its commendable support for multiple payroll calculation modes, accommodating diverse employee types with variable compensation structures. This includes:

- Periodic Fixed Salary: Ideal for full-time employees.

- Hourly Wages: For contract or part-time staff.

- Piece Rate Wages: Suited for production or manufacturing roles, where pay is linked to the quantity produced.

5. Customizable Additions and Deductions

Worried about how to handle addition and deduction in the payroll process? Get LOGIC ERP software to customize your company’s payroll management in an easy way. Administrators can now easily create custom additions or deductions for each employee, ensuring that payroll reflects individual conditions, such as performance bonuses, penalties, or company-specific allowances.

6. Overtime and Undertime Management

How to handle time tracking for payroll management systems? Get our Salary Payroll Software and track overtime and undertime accurately by calculating wages based on hours worked. With customizable options, this advanced payroll management system allows companies to add overtime pay for weekends and holidays, making it easy to adapt payroll to specific company policies.

7. Shift-Based Payroll Management

Do you have shift based working hours? No worries, our advanced payroll management software offers the best capabilities to handle shift based employment. The advanced shift-wise payroll features simplify it by tracking attendance, calculating hours, and ensuring employees are paid correctly for their specific shifts. This feature is especially useful for industries like manufacturing or hospitality.

8. Attendance Import and Tracking

Tired of spending hours on payroll adjustments and attendance tracking errors? Let’s make it easy with our advanced payroll management software. It allows attendance data to be imported from external sources such as Excel or biometric devices, helping to eliminate manual entries and ensure accurate payroll calculations. This automation feature saves time and reduces errors.

9. Leave and Holiday Management

Now you can simplify leave and holiday management with our HR & Payroll Software, offering options for various leave types—like casual, sick, or optional—along with automatic tracking of paid leaves, holidays, and even weekend overtime. Employees get paid accurately, even during company holidays, without requiring extra HR oversight.

10. Loan and Advance Tracking

If your company provides loans or salary advances, payroll tracking system ensures these are accounted for. Monthly deductions are automatically applied to employee payrolls, saving time and making sure repayments stay on schedule.

11. Production-Linked Payroll for Piecewise Work

With the option to link payroll directly to production outputs, HR Payroll Management System in India is perfect for companies using a piece-rate pay structure. Payroll is automatically calculated based on units produced, eliminating the need for manual tallying and ensuring fair pay for workers.

12. Statutory Compliance and Tax Management

Compliance is the most important yet challenging part of the payroll management. Our cloud-based HRMS and payroll software in India comes up with built-in tools for statutory reports, tax calculations, and TDS deductions, making it easy to regulate the tax compliance. With automated compliance reporting, businesses can stay ahead of regulatory requirements without manual tracking, avoiding penalties and ensuring compliance with ESI, Provident Fund, and other local mandates.

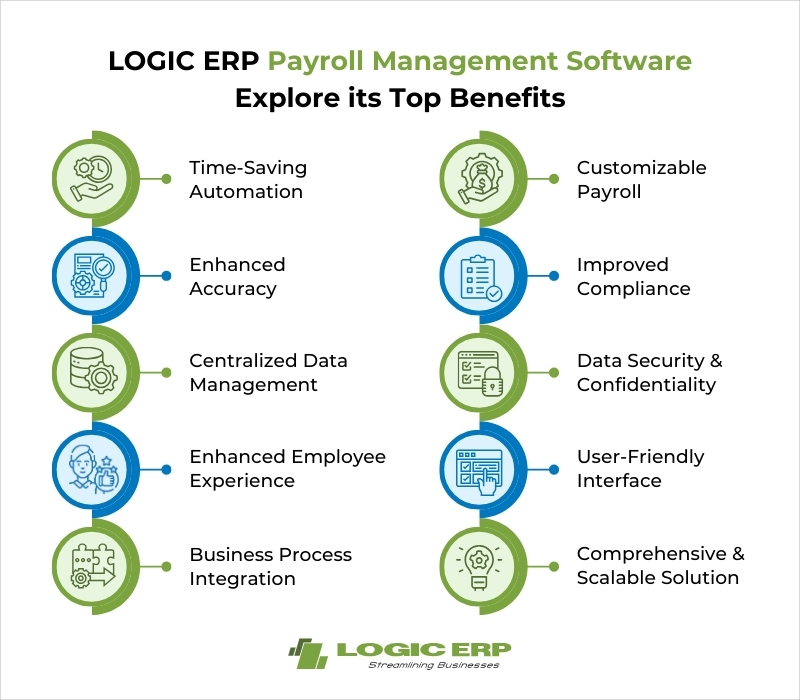

LOGIC ERP Payroll Management Software | Explore its Top Benefits

Our employee salary management solution offers numerous benefits that help businesses manage their payroll with greater accuracy and efficiency:

1. Time-Saving Automation

By automating payroll calculations, leave management, and attendance tracking, advanced ERP software eliminates repetitive tasks, freeing up HR staff to focus on strategic initiatives.

2.Enhanced Accuracy

Manual payroll processing is prone to errors, but LOGIC ERP’s automation and data integration features ensure precise calculations for salaries, taxes, and deductions.

3.Improved Compliance

The built-in compliance features for ESI, Provident Fund, and TDS help organizations meet regulatory requirements, reducing the risk of penalties or legal issues.

4.Customizable Payroll

With support for various payroll modes, LOGIC ERP can be configured to meet the specific needs of different employee groups, providing flexibility that other payroll processing systems may lack.

5. Centralized Data Management

Multi-branch organizations benefit from centralized payroll data, which allows for consistency and better reporting across all locations.

6. Enhanced Employee Experience

Our advanced payroll management software helps to reduce payroll discrepancies, improve employee trust and satisfaction.

7. Integration with Other Business Processes

LOGIC ERP can integrate with other modules within the LOGIC Enterprise Suite, ensuring that payroll data is synchronized with finance and accounting systems, which provides a holistic view of financial health.

8. Data Security & Confidentiality

Payroll data is highly sensitive, and LOGIC ERP includes robust security measures to protect employee information. Businesses can control access to specific payroll data, ensuring only authorized personnel handle sensitive information.

9. User-Friendly Interface

The software’s intuitive interface makes it easy for HR personnel to navigate through payroll features, from employee record management to attendance tracking and compliance reporting. A user-friendly design minimizes training time and enhances productivity.

10. Comprehensive & Scalable Solution

Get ERP software to manage all aspects of payroll, from basic salary calculations to complex statutory compliance. Its scalable architecture ensures it can seamlessly adapt to your business growth without requiring major changes.

Conclusion

Payroll is the integral part of every business and its proper management requires an advanced solution that helps to maintain accuracy at the best level. With our payroll management software for small business and large scale industries, professionals can seamlessly manage payroll for diverse employee groups across branches, making it a valuable asset for companies looking to enhance efficiency and transparency in payroll management.

From detailed employee records to compliance management, this best payroll software in India provides a streamlined system that reduces manual errors, enhances compliance, and saves time for HR departments.

If you are looking for the best payroll management software to automate complex payroll tasks and simplify compliance requirements now!

Contact us or Give our experts a call at +91-734 114 1176 to schedule a free demo, or send us an email at sales@logicerp.com right now!