This patch helps you configure GST configuration in LOGIC Application. Please go through following details before downloading the patch

How To Run

1.

Download the patch from download link provided at the bottom of this page

2.

After download double click on the exe to run.

3.

You will see a wizard which will guide you in configuration process

4.

This patch requires latest update for LOGIC application. Please update your

software before running this patch.

*Please note that this patch will make changes in

tax setups. Do not run this patch if you have already completed GST tax setup or

want to setup manually.

Please contact

LOGIC Support if you need any

clarification regarding this patch

Please click on the download button to download this Patch

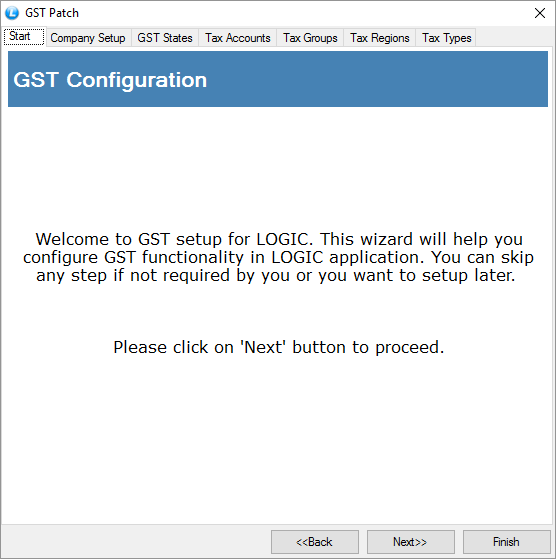

How to use this patch1.Start Page

This page is the introductory page of the wizard

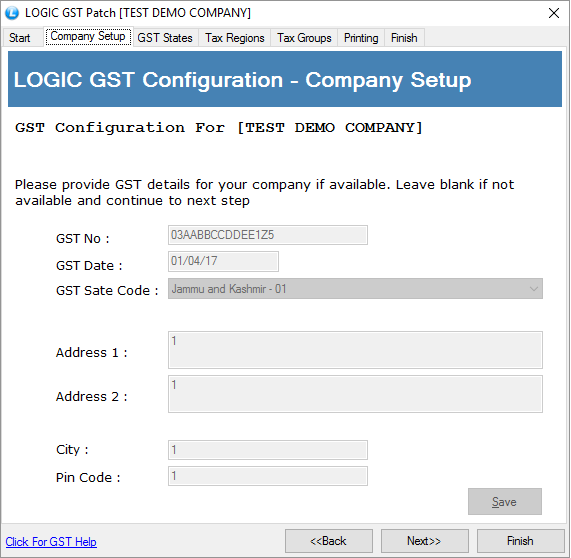

2.Company Setup

This page asks you about the GST details of your company like GSTIN, GST Date and GST State. If you have all these information with you, please enter the details otherwise skip this step by clicking on next

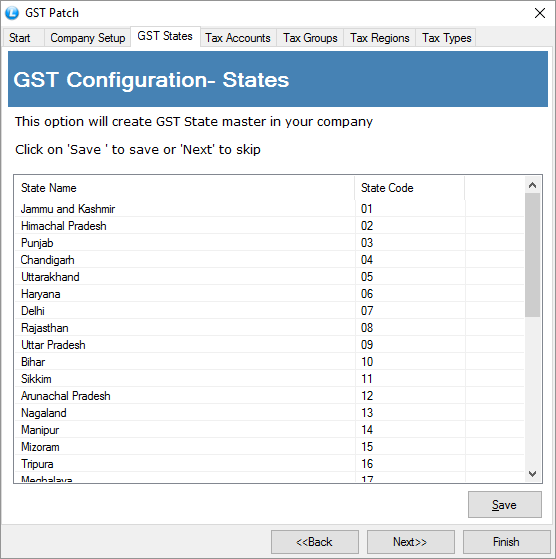

3.GST State masters

State masters provided by GST have to be created in your company for proper filing of GST return. This screen automatically creates all the states given in GST state master. Just click on Save or click on Next to skip

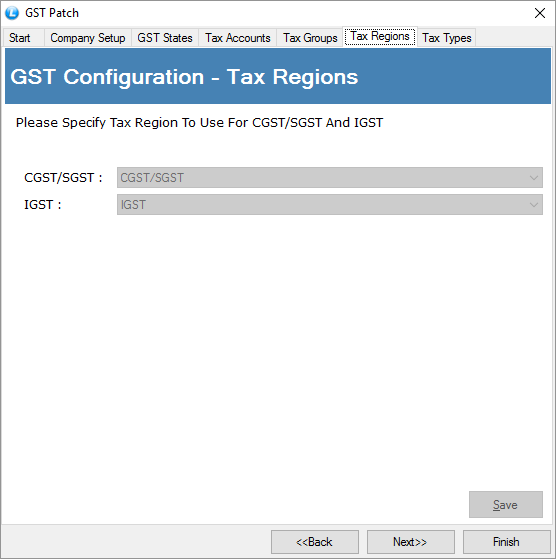

4.Tax Regions

This screen helps you specify tax regions to be used for CGST/SGST and IGST. By Default Tax Region-1 will be used for CGST/SGST and Tax Region-2 will be used for IGST. You can keep these as it is or specify other Tax Regions to be used.

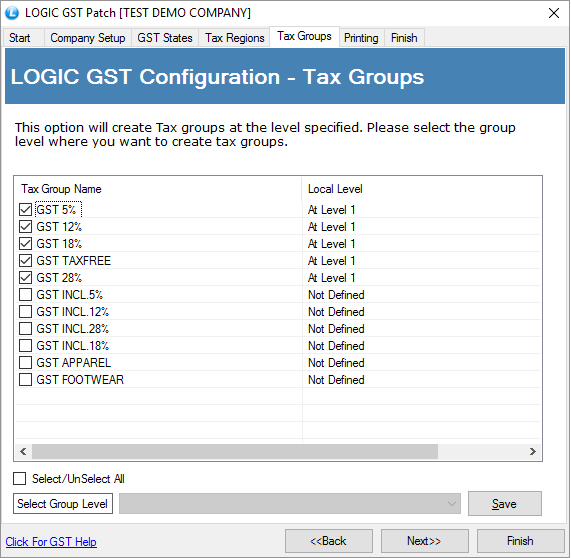

5.Tax Groups

This screen will create Tax Groups for items. Please select the group level where you want to create Tax Groups. Please note, taxes will be allocated on the basis of tax groups. Allocate items to relevant tax group for implementing taxes.

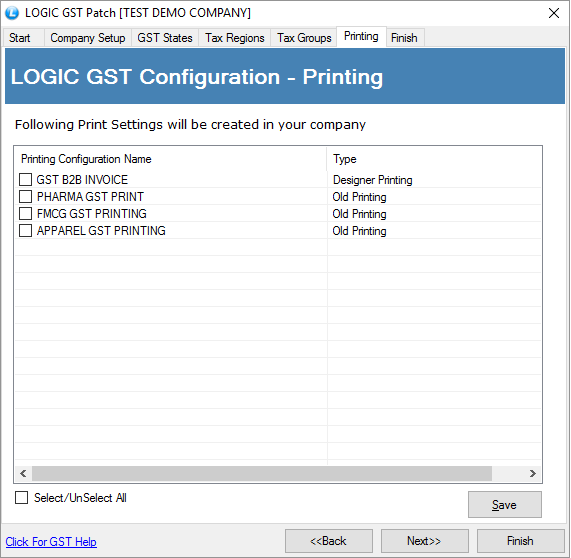

6. GST printing

This screen will create printing configuration. Please select the printing you want to configure

After you have successfully completed the configuration process, you will be able to use new Tax Structure just by allocating items to Tax Groups