| Show/Hide Hidden Text |

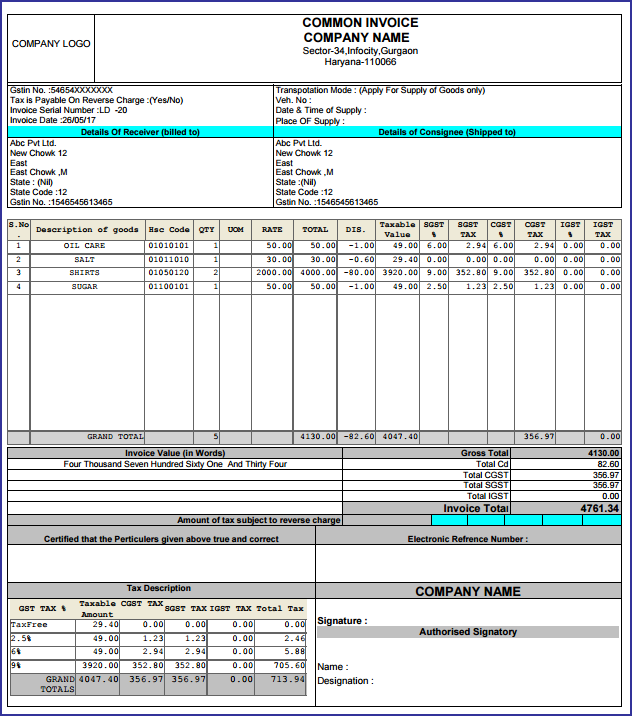

![]() Open Sale Bill Print Designer and Printing if you are using . Net Printing. We have added many GST fields that enable you to enter your GST no, GST Amount and GST tax etc.

Open Sale Bill Print Designer and Printing if you are using . Net Printing. We have added many GST fields that enable you to enter your GST no, GST Amount and GST tax etc.

![]() Sale Bill Printing is classified into three types.Following are the changes after GST Implementation in the Printing.

Sale Bill Printing is classified into three types.Following are the changes after GST Implementation in the Printing.

Fig 1. Fields to Add AE Customers

Fig 2. Fields to Add Customers

Fig 3. Fields to Add Company

Fig 3. Fields to Add Branch GST

|

CGST:

Fig 4. Fields to Add CGST Tax in Item Details

SGST:

Fig 5. Fields to Add SGST Tax in Item Details

IGST:

Fig 6. Fields to Add IGST Fields

|

CGST:

Fig 7. Fields to Add Total CGST Tax

SGST:

Fig 8. Fields to Add Total SGST Tax

IGST:

Fig 9. Fields to Add Total IGST Tax

Tax Description:

Fig 10. Fields to Add Tax Description Fields

|

Print Preview: